Did you know that November 2015 has been designated Canada's national Financial Literacy Month (FLM)? Get in the spirit this November by checking out the great events the Bronfman Library has organized for FLM 2015, the online resources we've compiled such as budget calculators, and our handy display of personal finance books in the Bronfman Library's fireplace lounge!

Becoming financially literate means that you're able to make responsible financial decisions and plan for the future. Here are some examples where financial literacy is very useful:

- making a budget to make sure you don't overspend each month

- researching student loan options

- understanding how interest works and what this means for your student loan(s)

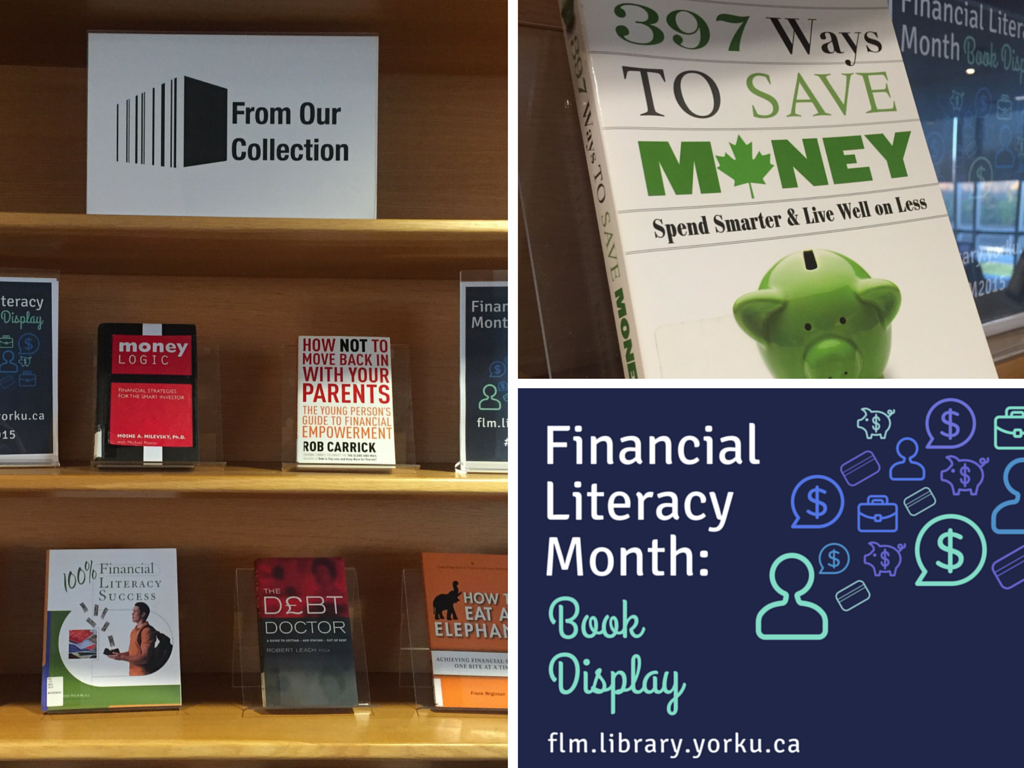

Get started on improving your financial literacy today by checking out some of the books in our personal finance display. Here are just a few of the useful titles available for borrowing:

- The Wealthy Barber Returns by David Chilton

- David Chilton returns in this follow-up book to his wildly successful personal finance book, The Wealthy Barber (also available in the display). Chilton approaches personal finance in a conversational manner and uses humour to teach his audience about debt, saving, emergency funds, and much more!

- Saving for School: Understand RESPs, Take Control of your Savings, Minimize Student Debt by Gail Vaz-Oxlade

- Perhaps you've watched the addictive TV show Til Debt Do Us Part? Well, Gail Vaz-Oxlade, the personal finance guru from the show, brings you her advice and wisdom on saving for school in this book. While the book focuses a lot on RESPs, it also covers how to budget and student loans. This is just one of the books by Vaz-Oxlade in our display.

- The Debt-Free Spending Plan by JoAnneh Nagler

- JoAnneh Nagler offers a straight-forward plan for getting your spending habits in order and reducing your debt! She offers advice on tools to use and provides many examples to help you reign in your spending habits and get your debt under control.

Check out the full list of titles in the display here. We hope that this display will help you brush up on your financial literacy skills during November. Happy reading!